Please enter below to receive more information.

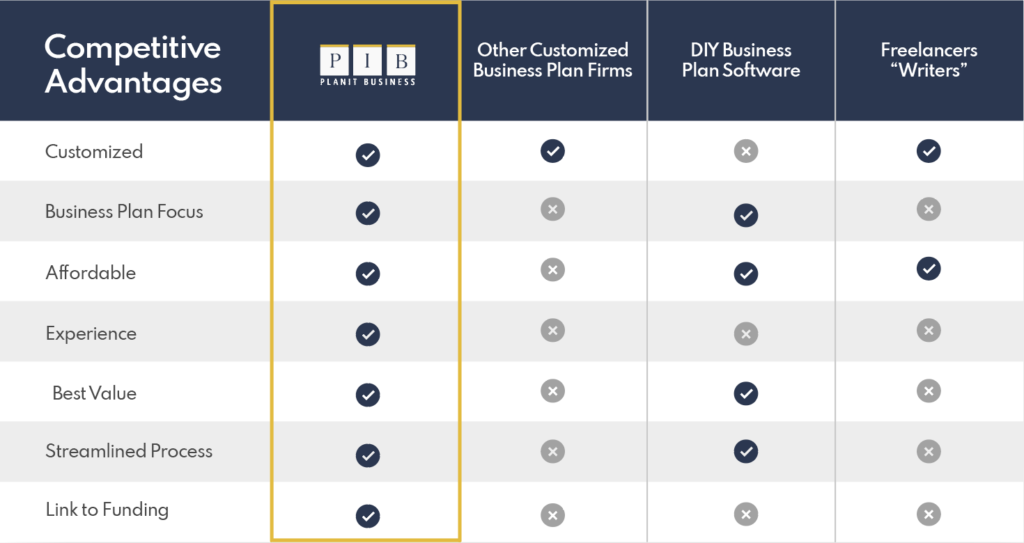

PlanIt Business (“PIB”) is a customized business plan writing company that specializes in business plans written for funding purposes. Our clients seek highly compelling and actionable business plans in order to raise capital in the form of bank loans (commercial and SBA) or equity investment (Friends & Family, Angel Investor, Venture Capital / Private Equity). Our business plans can also be tailored for pitches, proposals, joint ventures, management recruiting, board presentations, etc. Whenever you find the need to ask for something and need a document to represent that ask – – we can help you.

We’re proven and validated. We’ve been writing business plans and growing our investor network since 2009! That’s a lot of business plans! We have thousands of positive reviews. Our business plans and investor network has funded over $2 billion over the years. We’ve won business ethics award as nominated and voted on by our clients. Shark Tank’s Daymond John chose PIB to be his exclusive business plan provider for his start up academy.

We’re qualified. We are a team of Ivy League MBAs who also have extensive prior experience in Investment Banking, Venture Capital and Private Equity. Our team are alumni from top companies such as Google, Inc., Intuit, Bank of America, Merrill Lynch and Andersen Consulting. Suffice it to say, that while other business plan companies only “write about it”, we’ve actually have “done it.” The founder of PIB has started half-a-dozen companies himself and knows how much work it takes to get a business off the ground.

We have empathy. We know how you feel. You are taking a big risk (most likely the biggest of your career), money is tight and the future is uncertain. We’ve been there. You are passionate about your business concept but at the same time, need to be judicious about how you spend and careful with each move you make. This is why we have streamlined our business model to be able to offer you a below-market price and turnaround what you need in less than half the industry standard wait times, while maintaining the highest of quality.

We are Efficient. Less than market prices, less than half the turnaround time! While we do customized work, we utilize our in-house developed software technology to handle the administrative tasks.

Over the course of the last 20 years, we have become semi-experts in just about every industry you can imagine. We write business plans for all industries including: technology, manufacturing, retail, e-commerce, food & beverage, energy, cannabis, industrial, real estate, health care, professional services, sports, entertainment, education, government, non-profit, and other.

Our Expertise

Our team is made up of full-time, in-house writers and analysts who have credible previous experience in Investment Banking, Venture Capital, Private Equity, Fortune 500; start up and entrepreneurial experience; writing own business plans to raise capital. We have on staff MBAs from top Business Schools, MENSA High IQ Society members and community leaders. PIB’s CEO founded a software company for which he wrote the business plan that raised about $6 Million in private capital; CEO ran the company, grew it and successfully exited it within 3 years.

Providing the Link to the Capital

We, at PlanIt Business, have developed an extensive network of over one thousand funding partners that include lenders, investors, strategic buyers and private equity. Talk to us about getting your business plan to these funding sources.

Going the Extra Mile

PIB is a real company, with real growth and real satisfied customer validation. We want to become your long-term business partner and we want our relationship to grow along side of your business. Beyond creating high quality business plan materials, we offer advice, an objective 3rd party perspective, make introductions that might be helpful to you and really put ourselves into your shoes and think for you. We are not a “fly by night” operation or a random freelance writer who could be “here today, gone tomorrow,” but rather a permanent piece of the global private funding process.